Dear readers,

Updating on global market performance from 1st of January to the 31st of October.

We see that the US market has continue to show a strong performance riding into 2021. Both the S&P500 and NASDAQ have returned more than 20% for the year. This is probably due to the monetary policies implemented at the start of the covid crisis in year 2020 by the US FED. Unprecedented QE was employed and even more liquidity flooded the market this covid crisis compared to the last Global Financial Crisis. This firm and decisive action by the FED had prevented an economic meltdown and continued to provide fuel to the stock market.

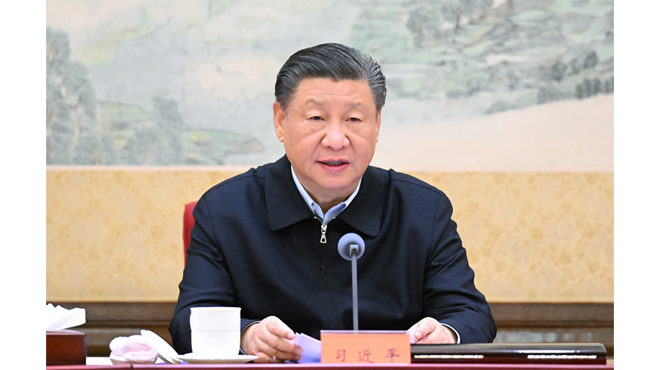

The China and Hong Kong markets took a heavy beating from the Chinese government’s regulatory crackdown and both are the worst performing markets thus far into 2021.

Asia has continued to suffer from the resurgence of the covid virus periodically, with various countries going into lockdowns at different time. This has affected the performance of the rest of the Asian Markets like Japan and Singapore.

The European markets have shown great progress in their recovery from the pandemic as countries started opening up, though at a slower pace with hiccups in between.

Whats next?

We are nearing the end of 2021 and historically, the 1st and 4th quarter tend to be the best performing months for the global stock market. I continue to stay positive on the global recovery from the pandemic. The route to recovery will be uneven for different economies as the pandemic remains pretty fluid. But with the introduction of more medical advancement to tackle the virus, we should be at the tai-lend of the pandemic, at least economically, as countries start to open up their borders.

I see opportunities in the HK and China markets for 2022 with their cheap valuations vs global peers. I feel that the selling was overdone (which is always the case, too much fear).

In the US, i continue to hold positions in the travel industry (reopening play), banking and finance (inflation theme) and technology names (historical data – from 2013 to 2015, which is when the FED last tapered QE, technology continued to perform).

We should see US continues to lead global markets in the pandemic recovery and the rest of the world playing catchup!

That’s all for this week and profitable investing everyone!