Variable Interest Entities Explained

Chinese Companies Delisting Risks – Reality Check

1. Behaviour of Chinese ADRs inconsistent

If we assume that the market is pricing in delisting risk of the Chinese ADRs, I would assume that the movement of all the Chinese ADRs will be the same but apparently, from the above chart, it is giving us another view.

2. Didi’s Delisting

The case for the delisting of Didi from the US exchange is unique!

- Didi continued to list even when the Chinese regulators disapprove of it

- Didi did not ensure data security prior to listing

- The Cyberspace Administration of China found serious violations in how Didi collected and used personal information.

3. Neither the US or China will benefit

- Asia Financial estimates that the massive delisting of Chinese stocks on US exchanges threatened more than $1.1 trillion of US investors’ investments.

- The United States is China’s largest trading partner.

- Massive re-listing in HK will suck liquidity from the market.

Risks Remain

- Many companies targeted by Chinese regulators have ADR listings in the U.S., while the Securities and Exchange Commission finalized rules that allow it to delist foreign stocks if they don’t meet audit requirements.

- Multiple offshore Chinese developer bond maturities in 1Q22 may result in more volatility if there would be more defaults.

- Potential pressure on liquidity from Chinese ADRs fund raising.

- China’s policy and regulatory risks.

What’s Next?

- As regulatory risks rise in China, investors should reduce their exposure to Chinese stocks listed in the US.

- Prudent for holders of these stocks to diversify, hedge their exposure, maybe switching to some of the Hong Kong-listed stocks where there’s a dual listing to hedge against this delisting risk.

Light at the end of the Tunnel…

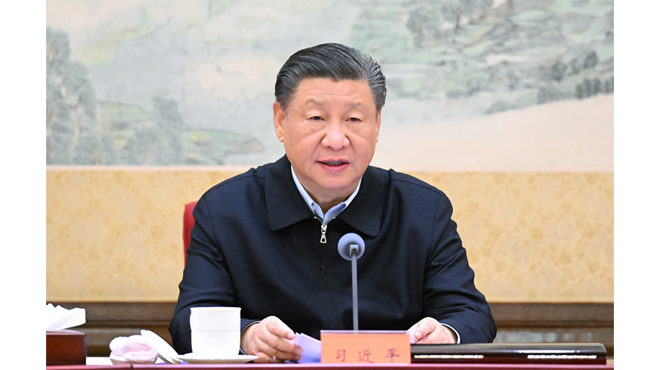

- The Central Economic Work Conference (CEWC) sent a clear message that economic stability being the top policy priority in 2022.

- Local authorities and ministries responsible for macro-economic stability.

3 key areas of focus namely:

- accelerating fiscal spending and infrastructure construction.

- flexible monetary policy.

- marginal easing in real estate sector.

Opportunities…

- Companies and sectors with policy support to drive growth – Chip making

- Those with strong cash flow and dividend support – Chinese Banks.

- Long-term structural growth (COP26 – Combating global climate change) – renewables and new energy vehicles.