No place like home

Maintain BUY call with lower TP of MYR3.38 (-1%)

Conversations with channel checks reveal that RWG 4Q21 visitorship was robust despite the opening of Genting SkyWorlds (GS) being delayed yet again. Moreover, other indicators reveal that the upcoming Chinese New Year will be a good one for RWG. We tweak our FY21E/FY22E/FY23E earnings estimates by +2%/-5%/-6%. Maintain BUY call with a slightly lower MYR3.38 DCF-based TP (MYR3.40 previously). We continue to like GENM as a liquid recovery play.

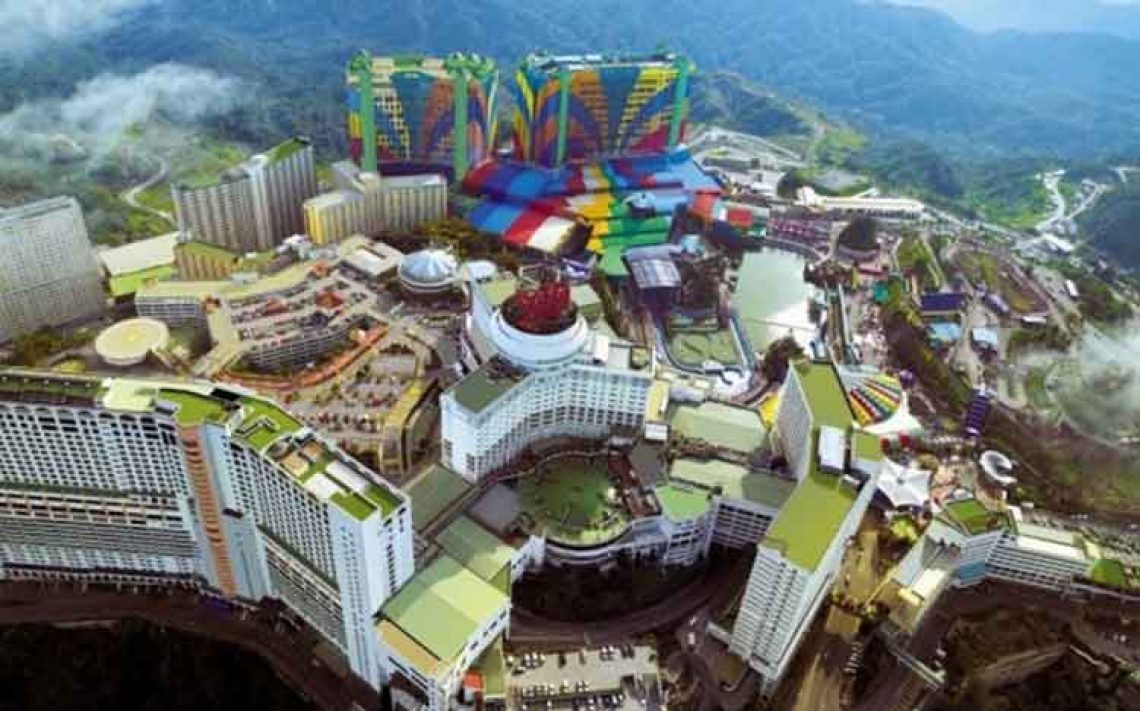

GS opening delayed but RWG 4Q21 visitorship robust

We expected GS to open on 10 Dec 2021 but it did not come to pass. Channel checks inform us that GENM is ‘ironing out’ software issues and hopes to open GS for Chinese New Year which falls on 1 Feb 2022. Yet, we understand that RWG 4Q21 visitorship was robust and comparable to 3Q20 (4.0m). Thanks to a high vaccination rate (Fig. 1), the number of new COVID-19 cases and deaths in Malaysia has eased (Fig. 2). Sceptics may say that the latter is due to the recent floods in the Klang Valley but elevated testing rates dispel this concern (Fig. 3).

2022 CNY shaping up to be a good one, in our view

Google Mobility Retail & Recreation Index, which measures interest in retail and recreation relative to pre-COVID-19 times, indicates that Malaysians are a lot more comfortable outdoors today which is very positive for RWG (Fig. 4). Google Trends, which measures search interest in a particular term, also indicates that RWG is ‘front of mind’ for many Malaysians during holidays (Fig. 5). If the Omicron variant is kept at bay, the upcoming Chinese New Year ought to be good for RWG.

Trim long term earnings estimates by 5-6%

Although we now defer our expectation on the opening of GS from 4Q21 to 1Q22, our FY21E LBIT is narrowed by MYR51m as we expect GS to be loss making. Our FY22E and FY23E EBIT are unchanged. On another note, we raise our net interest expense estimates by MYR63m p.a. to reflect 3Q21 results. Net impact is to narrow FY21E net loss by 2% but trim FY22E and FY23E net profit by 5-6%. Consequently, our end-FY22E DCF-based TP is trimmed slightly to MYR3.38 from MYR3.40.