- Relatively firm US growth compared to EM and a hawkish US Fed will prove challenging for Asia rates in early 2022

- Bond supply pressures and possible demand gaps as central banks and domestic banks pull back on their bond purchases are additional challenges for Asia

- The environment for Asia rates could turn more conducive later this year when Fed pricing/Asia tightening gets digested

- Key Theme 1 – Asia rates performance could deteriorate in the early part of the Fed tightening cycle. It is too early to receive against aggressive Asia hike pricings.

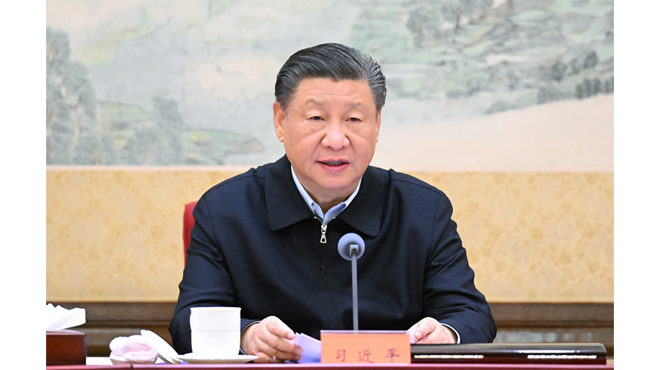

- Key Theme 2 – China’s divergences on growth trajectory and policy bias to be fully reflected in the outperformance of CNY rates in 2022.

- Key Theme 3 – Cheap valuations and low foreign ownership across Asia bonds could provide some cushion against the expected challenging environment.

- On a relative basis, we expect China, Indonesia and South Korea bonds to outperform. And Thailand and Malaysia bonds to underperform.