The Fed’s monetary policy has little impact on China, as the country looks towards monetary easing instead. We predict that the Fed would have 12 rate hikes of 0.25% each by 2023, which would bring the federal funds rate to 3.25%.

- iFAST Research Team | Published on 29 Mar 2022

- Rising interest rates are on the horizon, with the high inflation and employment rate in the US. The Fed recently raised interest rates by 0.25% — the first increase in more than three years, as it looks to address surging inflation.

- The Fed’s long rate hike cycle is a challenge for the financial stability of various economies. We predict that the Fed would have 12 rate hikes of 0.25% each by 2023, which would bring the federal funds rate to 3.25%.

- During this interest rate hike cycle, investors should avoid investing in developing countries with low economic health and high external debt ratios. However, the Fed’s monetary policy has little impact on China, with the country looking towards monetary easing instead of tightening.

- Investors can participate in China’s stock market via the Xtrackers Harvest CSI 300 China A-Shares ETF (NYSE:ASHR). The three major indices in China are trading at attractive valuations, and we see huge potential in the Chinese market in the longer-term.

Background of the Fed rate hike

Although inflation and employment rates are two important indicators used by the Fed to set interest rate goals, the market tends to pay more attention to the inflation rate.

Figure 1: Unemployment and Inflation Rate Model

Figure 2: The Non-farm Payrolls

As of Feb 2022, US consumer prices (CPI) climbed by 7.9% year-on-year, the highest level in nearly 40 years. Even if we exclude food and energy prices, core inflation has risen by 6% year-on-year. Hence, a rate hike by the Fed is long overdue (Figure 1).

Besides, the US unemployment rate and non-farm payrolls data have exceeded expectations recently (Figure 2). As evidenced from previous rate hikes, the US is more likely to start the process of raising interest rates when the employment rate is close to the target, by which the median is 3.5% for 2022.

Impact of rate hike cycles on other economies

Judging from the three important interest rate hike cycles since the 1980s, once the Fed started raising interest rates, it adopted a continuous rate hike cycle, which had a negative impact on non-healthy/developing economies.

For example, during the interest rate hike cycle in the 1980s, interest rates were raised 16 times a year. The federal interest rate rose from 6.50% to 9.81%, resulting in the debt crisis of Latin American countries. Moreover, the rate hike cycle in the 1990s triggered the Asian financial crisis. After 17 interest rate hikes in two years, the federal interest rate increased from 1.00% to 5.25%, which led to the subprime mortgage crisis and the European debt crisis (Figure 3).

Figure 3: The change of Fed rate

Taking into account the Fed’s slow reaction, and the high inflation within the US, we think that there could be a total of 12 rate hikes of 0.25% each — 7 hikes in 2022 and 5 hikes in 2023, under an aggressive tightening scenario. This would bring the federal fund rate (FFR) to 3.25%.

When the Fed raises interest rates, investors should pay attention to the risks posed by developing countries with high external debt ratios, as rate hikes test the financial structure of their economies.

Rate hikes have little impact on China

US and China are on two opposite ends of the spectrum right now. US is faced with high inflationary pressures, while the Chinese Consumer Price Index (CPI) has been running at a low level – roughly 1% in the first quarter of 2022.

Unlike many global peers, the People’s Bank of China (PBOC) has maintained an accommodative monetary policy. In January 2022, the PBOC cut its key lending rates – a first since April 2020 (i.e. the peak of the pandemic) – amidst concerns about an economic slowdown, dragged by a property market downturn and a strict zero-COVID policy.

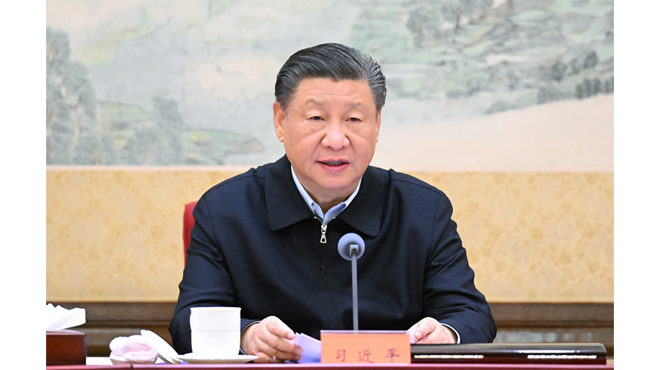

Moving forward, all eyes will be on the 20th Party Congress, which is the main political event of the year. Due to be held in late 2022, the 20th Party Congress is responsible for formally approving the membership of the Central Committee. This will also determine whether President Xi Jinping continues for another presidential term.

With weakening economic growth in face of multiple headwinds, China is likely to roll out more policy measures in order to stabilise the economy before the 20th Party Congress. Hence, we believe that there is a strong case to be made for the PBOC to keep an easy monetary policy.

Therefore, the monetary policy demands of China and US are highly different. China’s monetary policy will aim to “maintain stable growth”, while US has to solve the problem of high inflation. Coupled with the independent monetary policy tone of China, the Fed’s debt reduction process or interest rate hike process is unlikely to have much influence on China’s stock market.

Figures 4 & 5: Year-on year CPI data & Different Monetary Policy in 2018

When we look at the past performance of China’s stock market in the previous two Fed rate hike cycles, it tends to go through some correction before monetary tightening officially starts. But when the Fed starts to raise interest rates, the negative impact on the Chinese market lessens, likely because the market has already priced it in (Table 1).

Table 1. The performance of Chinese assets in the previous two Fed rate hike cycles

| (%) | 2004/6—2006/6 | 2015/12—2018/12 | ||||

| One year ago | Half year ago | In period | One year ago | Half year ago | In period | |

| SSE index | -6.54 | -14.10 | 18.66 | 14.89 | -13.47 | -28.27 |

| SICOM Index | 1.49 | -14.17 | 30.80 | 20.16 | -9.85 | -40.70 |

| SSE 50 | -10.23 | -18.44 | 22.64 | 1.12 | -8.93 | -2.77 |

| CSI 300 | -11.65 | -17.80 | 28.63 | 11.39 | -11.48 | -17.39 |

| CSI 500 | 48.82 | 43.69 | -14.17 | -43.62 | ||

| ChiNext PRICE Index | 81.94 | -4.31 | -52.10 | |||

| China Bond index | -1.27 | -0.84 | 12.20 | 8.12 | 4.81 | 10.28 |

| Nanhua Com. Index | 0.71 | 0.71 | 26.00 | -13.32 | -11.83 | 57.53 |

Potential risks

Ending monetary easing: This might happen in the case where China’s CPI starts to climb faster than expected against the backdrop of global inflation, which makes the PBOC end monetary easing earlier than expected.

Geopolitical tensions: Tensions between US and China leads to a new round of trade war, putting pressure on China’s economy, hurting investor sentiment.

Getting exposure to China’s market

The Fed’s rate hike cycle is unlikely to have a big impact on China. From a monetary policy perspective, China is in a different place as compared to the rest of the world. It is likely to keep an easy monetary policy in order to stabilise the economy.

We are bullish on China’s stock market in the long term. Investors can gain exposure to the opportunities within the MSCI China Index, which reflect the performance of the Chinese equity market, via the iShares Core MSCI China ETF (HKEX.2801) or the actively-managed JPMorgan Funds – China A (acc) SGD. For investors who may be interested in China’s domestic A-shares market, they can consider the iShares Core CSI 300 ETF (HKEX:2846) or the Allianz China A Shares AT Acc SGD.

Table 2: Recommended products for Chinese equities

| Equity Market | Unit Trust | ETF |

| China | JPMorgan Funds – China A (acc) SGD | iShares Core MSCI China ETF (HKEX.2801) |

| China A-shares | Allianz China A Shares AT Acc SGD | iShares Core CSI 300 ETF (HKEX:2846) |