Monthly Market Pulse: Policies support to turn the tide

- Negatives should be priced in as overhangs persist but there is nothing new

- Weight of multiple policy supports on sectors will eventually turn around the overwhelming negative sentiment

- Low confidence amongst investors offer opportunity to revisit undervalued market

- Favour sectors that benefit from policy supports, overhang removal and rising interest rates. This includes renewable energy, internet and new economy, auto, and HK Banks.

Policy supports directly address market concerns. Inflation, rising interest rates, supply chain disruptions, and COVID resurgences have left the HK market stagnant YTD. Despite attractive valuation of <10x FY22 P/E, investors’ confidence remains low as the “wait and see” approach is the overwhelming consensus. whilst overhangs persist, they are nothing new, and the various policy supports introduced by the government looks to finally turn the tide. China’s cabinet introduced 33 policies to support businesses, boost infrastructure investment and reduce supply chain disruptions.

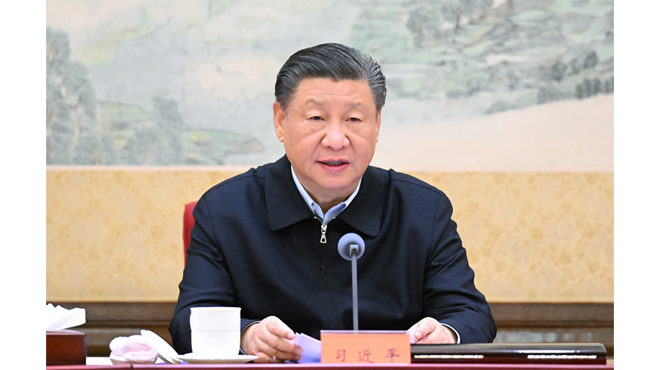

Clear policy support on platform companies should finally remove overhang from the new economy/tech sector. While it is hard to predict the outcome and timing of the Ukraine conflict and the peak of inflation or COVID, uncertainties regarding new economy sector have certainly been priced in. Comments from high-ranking officials and resumption of games approval are clear signs that the key overhangs are removed. The market should focus back to the new economy to play the likely rebound, given its attractive valuation and signs of easing from regulatory developments. The sector is also relatively shielded from rising inflation, supply chain disruption, and China property crisis.

Favour sectors that benefit from policy support, overhang removal and rising interest rates. Given the low investor confidence, we believe sectors that offer more visibility will outperform. Policy supports for the renewable, autos and infrastructure sectors are obvious beneficiaries. We also argue that investors should pay attention to the new economy and tech sector as the regulatory crackdown is over. Finally, HK banks enjoy tailwinds as they are clear beneficiary of rising interest rates. We are cautiously optimistic for 2H, when overhangs should either ease or be fully digested by the market. We maintain our 12mth HSI target at 24,600, as the market is under-owned and ready for rebound.