There has been no shortage of headwinds facing China’s economy in 2022. Yet, despite the obvious risks, we think the deep sell-off in Chinese stocks could finally be on the cusp of a turnaround. We have upgraded Chinese equities, and we explain our rationale in this article.

You Weiren, CFA | Published on 10 Jun 2022

- There has been no shortage of headwinds facing China’s economy in 2022. Despite the obvious risks, we think the sell-off in Chinese stocks could be on the cusp of a turnaround.

- We expect China to roll out more policy measures to help support the economy. In fact, the government has already been rolling out economic support measures and fighting back against plummeting confidence in recent months.

- Adding to our optimism is the fact that China is emerging from its worst Covid-19 outbreak in more than two years, with daily Covid-19 cases trending down nationwide in recent weeks.

- Moreover, we believe that investors may have been too pessimistic on the earnings outlook for Chinese companies, following a string of better-than-expected earnings results.

- The valuations of Chinese equities look attractive, with a lot of negatives already priced in. With several catalysts on the horizon, we have upgraded Chinese equities from 4.0 Stars to 4.5 Stars “Very Attractive”.

From regulatory crackdowns, a crisis in the property market, renewed outbreaks of COVID-19, and the potential for Western sanctions given its relationship with Russia, there has been no shortage of headwinds facing China’s economy in 2022. While we have been positive on Chinese equities this year, our convictions have so far not worked out as expected, with the MSCI China Index down by -15.4% year-to-date to become the worst performing stock market under our coverage (Chart 1).

Chart 1: China is the worst performing stock market under our coverage

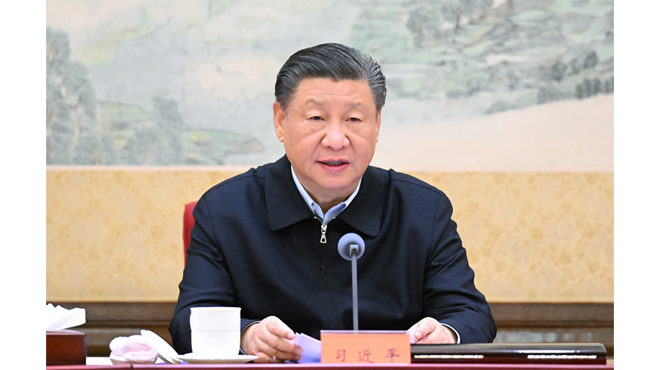

Few Chinese companies have caught the attention of global investors like its tech firms. For more than a year, President Xi Jinping unleashed a punishing regulatory crackdown on the country’s biggest tech companies, causing a catastrophic sell-off in the sector. At one point in March, the Hang Seng Tech Index – which tracks the 30 largest tech companies listed in Hong Kong and serves as a proxy for China’s tech sector – had lost about 70% of its value since its 2021 peak.

Once a beacon of opportunity, the world’s second largest economy now looks like a difficult bet, with some investors labelling China as “uninvestible” and giving up on the market altogether.

Yet, despite the obvious risks, we think the deep sell-off in Chinese stocks could finally be on the cusp of a turnaround, as the government rolls out more policy support measures, Covid lockdowns begin to ease, and signs of easing in the year-long crackdown on China’s tech sector. As such, we have upgraded Chinese equities from 4.0 Stars to 4.5 Stars “Very Attractive”.

We explain our rationale in this article.

Aggressive policy actions to stabilise the economy

As Chinese authorities continue to pursue a zero-Covid policy, provinces summing up to nearly 25% of national GDP have been under partial or full lockdown in March-April. The economic costs are becoming apparent: production and consumption have been hit hard, with industrial production falling -2.9% year-on-year in April (in contrast with expectations for a slight increase of 0.5%) and retail sales plunging -11.1% in April from a year ago (more than market expectations for a -6.6% decline).

Meanwhile, catering sales plunged by -22.7% year-on-year in April, while auto sales dropped by -31.6% from a year ago. In Shanghai, sales of cars were “about zero”, according to the Shanghai Automobile Sales Association. For an additional sense of the scale of economic slowdown in April, China’s unemployment rate climbed to a new high of 6.7%.

Unsurprisingly, many economists have trimmed their growth outlook for China, and most are not expecting China to achieve its 5.5% growth target this year. The consensus forecast for China’s full-year GDP growth for 2022 is currently 4.5%, well below the official government target.

While we acknowledge that the 5.5% growth target has become increasingly challenging to reach given the downward pressures on its economy, it still remains achievable – with effort. As such, we expect China to roll out more policy measures to help support the economy. In fact, the government has already been rolling out economic support measures (Table 1) and fighting back against plummeting confidence in recent months.

Table 1: Summary of key policy actions by the Chinese authorities

| Date | Policy Action |

| Jan 2022 | Cut one year LPR by 10 bps, cut five year LPR by 5 bps. |

| Feb 2022 | Banks in several cities lowered down payment ratio for first time homebuyers to 20% from 30. |

| Mar 2022 | Announced CNY3.45 trillion of special bonds for infrastructure investment, issuance to be completed by September. |

| Announced tax relief this year worth 2.5 trillion yuan. | |

| May 2022 | Banks reduced the lower bound range of mortgage interest rates for first time homebuyers by 20 bps. |

| Lowered the five year LPR by 15 bps. | |

| New round of 140 billion yuan in tax relief for the corporate sector and households, including a cut in the purchase tax on cars. | |

| Brought forward the deadline for special bond issuance to June, proceeds to be spent by August. |

In May alone, Chinese authorities have implemented a flurry of measures to support its Covid-battered economy. The central bank cut the lower-bound range of mortgage interest rates for first-time homebuyers, representing the first time in the current crisis that the central government has directly supported the housing market. Only a few days later, the central bank cut the five-year loan prime rate, the main benchmark for home mortgages, by 15 basis points – the biggest reduction since China revamped the interest rate mechanism in 2019. Meanwhile, on 23 May, China’s cabinet also introduced 33 policies, including CNY 140 billion in additional tax rebates and CNY 300 billion in railway construction bonds, to support businesses and stimulate demand.

“Verbal intervention” by the Chinese government has also become commonplace this year.

In a brief statement carried by state media in March, the Chinese government vowed to ensure stability in capital markets, support overseas stock listings, resolve risks around property developers, and complete the crackdown on big tech “as soon as possible”.

This was followed up with a meeting on 29 April, during which the Politburo said it will step up policy support for the world’s second-largest economy, including greater investments in infrastructure this year to boost growth. The Politburo also had some words of comfort for the beleaguered technology sector, with policymakers pledging to normalise regulation and support the development of internet-consumer companies, such as Alibaba and Tencent, marking the first strong sign of government support for big-tech companies since the start of a regulatory crackdown that began in 2020.

In May, Chinese Premier Li Keqiang warned of dire consequences if officials do not move decisively to prevent the economy from sliding further, saying a contraction in the second quarter must be avoided.

By now, it should be crystal clear that the Chinese authorities intend to move decisively this year to stabilise economic growth. Investors should also bear in mind that 2022 is a politically sensitive year for Present Xi, as he is seeking a historic third term as China’s president. He will certainly want to show that China has achieved great economic progress under his leadership.

China is emerging from Covid lockdowns

Adding to our optimism is the fact that China is emerging from its worst Covid-19 outbreak in more than two years. After months of strict curbs, China’s daily Covid-19 cases have been trending down nationwide in recent weeks (Chart 2), with the outbreaks in Shanghai and Beijing largely under control.

Chart 2: Daily Covid-19 cases have been on a downtrend

As cases continue to fall, major cities have been loosening their Covid-19 restrictions, with daily life mostly returning to normal. In Shanghai, seaport and airport cargo volumes are back at 90% capacity, while workers have been allowed to return to office, although they remain subjected to regular Covid-19 testing. Shanghai authorities have also given the green light for a partial resumption in public transport (Chart 3). Similarly, in Beijing, major shopping malls have started to reopen, ride-hailing and most public transport have resumed in the main business area, while more people have been allowed to return to work.

Chart 3: Public transport in Shanghai allowed to resume partially

While the news that some restrictions will end has been cheered by investors, risks remain.

China is unlikely to budge from its zero-Covid strategy, with leaders remaining determined to prevent the spread of the virus. China’s problem is that large portions of its elderly population remain unvaccinated more than a year after shots became available. The problem has been compounded by the high transmissibility of the Omicron variant of Covid-19. Relaxing restrictions could cause an “exit wave” of cases that would result in huge numbers of deaths. As such, any flare-ups are likely to lead to a re-imposition of growth-sapping Covid restrictions.

But all is not lost.

The Chinese government is well aware of the immense economic cost that comes along with its zero-Covid policy. We believe the desire and need to stimulate the economy is now so overwhelming that the Chinese government will continue to search for ways to accommodate, and be forced to soften certain aspects of their zero-Covid policy.

This is especially so after Chinese premier Li Keqiang summoned about 100,000 officials to an unprecedented video conference in May to express concerns about the slowdown and to push for a faster easing of lockdowns. The sheer scale of the meeting indicated the level of urgency and current challenges for the country to achieve its GDP growth target for this year. Premier Li said that an economic contraction the second quarter must be avoided, and urged officials to better balance Covid controls and economic growth – comments that were echoed by President Xi in a separate statement.

As such, there are reasons to believe that policymakers are indeed prioritising economic growth, and that China’s pursuit of zero-Covid will not come at the expense of its economy.

Earnings outlook has been overly pessimistic

Moreover, we believe that investors may have been too pessimistic on the earnings outlook for Chinese companies, following a string of better-than-expected earnings results. Alibaba reported better-than-expected earnings and sales for its most recent quarter, while Baidu also posted stronger-than-expected earnings report. Even though Baidu’s adjusted earnings per share in the 1Q 2022 was down by -9.3% from the same period last year, it still managed to beat earnings expectations by a wide margin – a sign that earnings estimates have been overly pessimistic.

This is in stark contrast to the US equity market, where earnings estimates for the S&P 500 Index have barely budged this year, but has already seen a number of high-profile earnings misses, especially from the likes of Walmart and Target. Target, in particular, has recently cut its profit outlook for the second time in almost three weeks. Amazon’s first quarter earnings were also a big disappointment, while Snap issued a profit warning and said it planned to slow hiring and spending. For comparison, earnings estimates for the MSCI China Index have already been slashed by 12.0% this year (Chart 4).

Chart 4: A stabilisation in earnings estimates for MSCI China Index

Furthermore, there has been a stabilisation in earnings expectations of Chinese companies. Based on Bloomberg data, analysts have stopped downgrading forward earnings estimates for constituents within the MSCI China Index. This leads us to believe that the risks in China’s equity market have largely been discounted by markets – a point that is further reinforced by the decline in Chinese equities and significant lowering of profits expectations year-to-date.

Besides, there are several catalysts on the horizon that could jumpstart a turnaround in Chinese equities, including an easing of China’s year-long crackdown on its big-tech companies.

As the country faces an increasingly grim economic outlook, regulators have been hinting that they may ease their scrutiny of the tech sector. The Chinese People’s Political Consultative Congress (CPPCC) held a special meeting in May on the digital economy, with Vice Premier Liu He highlighting the need “to support the platform economy.” This followed similar statements in April, during a Politburo meeting in which leaders vowed to support the “healthy” development of tech platform companies. In March, the government reiterated its intention to wrap up its crackdown on internet platform companies “as soon as possible”.

Policymakers have also been matching their words with actions to support the sector. China’s gaming regulator recently granted publishing licenses to 60 games, while authorities are also reportedly concluding its probe into ride-hailing giant Didi Global and are preparing to allow its app back on domestic app stores. In a rare concession, China has also expressed willingness to bring down an audit barrier involving US-listed Chinese stocks.

Valuations of Chinese equities remain attractive, upgrading Chinese equities

We urge investors to keep faith in China’s equity market. There is obviously a lot to worry about for China, but it is also fair to say that a lot of the negative overhang that has plagued Chinese equities have already been priced in to the markets. Moreover, the recent policy pivot towards easing has effectively put a floor on Chinese equities. We believe the market bottom is near.

The valuations of Chinese equities certainly look attractive, with the MSCI China Index having fallen to multi-year lows. The MSCI China Index is trading at a PE ratio of 10.3X 2024 estimated earnings. Applying our designated fair PE ratio of 14.5X on EPS projections for the next two years, we project a target price of 101 for the MSCI China Index by end-2024. This implies a 40.8% upside potential over the next two years.

Chart 5: Earnings forecast and price performance of the MSCI China Index

Table 2: EPS and upside projection for the MSCI China Index

| MSCI China Index | FY21 | FY22 | FY23 | FY24 |

| PE Ratio (X) | 18.3 | 14.0 | 12.0 | 10.3 |

| Expected Earnings Growth YoY | 3.3% | 5.1% | 17.1% | 12.6% |

| Earnings Per Share (EPS) | 5.67 | 5.96 | 6.97 | 7.85 |

| Projected Fair Price(based on fair PE Ratio of 14.5X) | – | – | – | 101 |

| Potential Upside from Today (%) | – | – | – | 40.8% |

| PE Ratio (X) | 18.3 | 14.0 | 12.0 | 10.3 |

| Source: Bloomberg Finance L.P., iFAST Compilations.Data as of 7 Jun 2022. |

As such, we have upgraded Chinese equities from 4.0 Stars to 4.5 Stars “Very Attractive”. Investors who wish to seek exposure to the Chinese equity market can consider the JPMorgan Funds – China A (acc) SGD or the iShares Core MSCI China ETF (HKEX:2801). For a pure-play exposure to China’s tech sector, investors can consider the iShares Hang Seng TECH ETF (HKEX:3067).

Our conviction towards Chinese equities has certainly strengthened over the past few months. With the government now signalling that the worst of the regulatory crackdown may be over, for now, the recent shift in policy stance towards aggressive easing completes our bullish case for one of the worst-performing markets so far in 2022.

If there is ever a good time to enter China’s equity market, it is now.

Table 3: Recommended products for exposure to Chinese equities

| Country | Unit Trust | ETF |

| China | JPMorgan Funds – China A (acc) SGD | iShares Core MSCI China ETF (HKEX:2801) |

| iShares Hang Seng TECH ETF (HKEX:3067) |