Recovery underway

- Recovery gains momentum post Singapore’s full reopening

- RWS 2.0 construction commenced in 2Q22

- Positive reading from Marina Bay Sands’ 2Q22 performance

Visitor arrivals to Singapore recovered to 35% of pre-Covid levels in Jun 2022

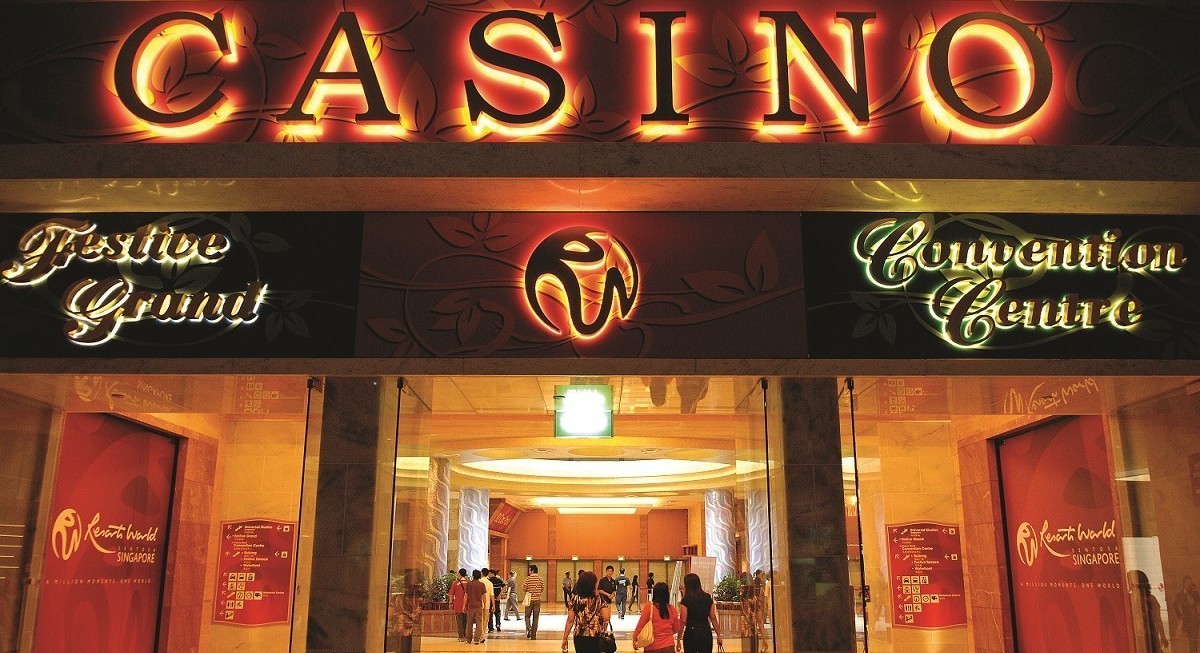

Following the easing of travel restrictions in Singapore, visitor arrival improved significantly by 143%, 42% and 30% MoM in Apr, May and Jun 2022 respectively, reaching 35% of its pre-Covid levels. There was particularly strong growth of visitor arrivals from Indonesia, India, Malaysia and Australia (36% of pre-Covid arrivals into Singapore). While China’s reopening of boarder remains uncertain (19% of pre-Covid tourists’ arrivals to Singapore), the shortfall could be partially replaced by visitors from other source markets due to strong pent-up demand, aiding the recovery of GENS.

Encouraging MBS’ 2Q22 results

Las Vegas Sands reported its 2Q22 results which showed encouraging recovery at MBS during the quarter, driven by Singapore’s full reopening. MBS saw strong growth across both gaming and nongaming segments. Adjusted property EBITDA grew 164% quarter-on-quarter (QoQ) to USD319m (185% year-on-year, YoY) in 2Q22, which was the best performing quarter since the onset of the

pandemic. We see MBS’ results as a positive to GENS which could suggest a faster-than-expected

recovery in 2Q22 following Singapore’s reopening in April 2022.

RWS 2.0 is targeted to open in 4Q24

GENS had commenced constructions works on both Minion Land and the Singapore Oceanarium in 2Q22. Targeted opening date is by end of 2024. As of 31 Dec 2021, GENS had net cash of SGD3.1b and is in healthy financial position to fulfil its commitment of RWS 2.0. Management also mentioned that they

are likely to review its dividend policy to reward shareholders. We expect a full year dividend of 2 Singapore cents per share in 2022. As countries reopen borders and ease travel restrictions, we expect better quarters ahead for GENS, barring the risks of a spike in Covid-19 cases and a recession. We revise our estimates to incorporate a faster recovery but higher operating costs. Our fair value estimate hence increases from SGD0.90 to SGD0.92.

ESG Updates

GENS lags its global peers on governance. GENS has related party transactions with the controlling

shareholder, Genting Overseas Holdings Limited (52.8% votes held). GENS demonstrates initiatives to

mitigate the effects of problem gambling such as advertisements, self-exclusion and voluntary visit

limit options. However, unlike better-performing peers, there is no evidence of play safe limits such

as voluntary money and time limit settings. BUY. (Chu Peng)