Highlighted Companies

BRC Asia Ltd ADD, TP S$2.50, S$1.71 close

3QFY22 net profit doubled yoy as the group benefitted from better profit spreads. GPM expanded 1.9% pts yoy to 7.1%. Order book remains solid at S$1.1bn in 3QFY22 (vs. 2QFY22: S$1bn). We reiterate our Add call with a TP of S$2.50.

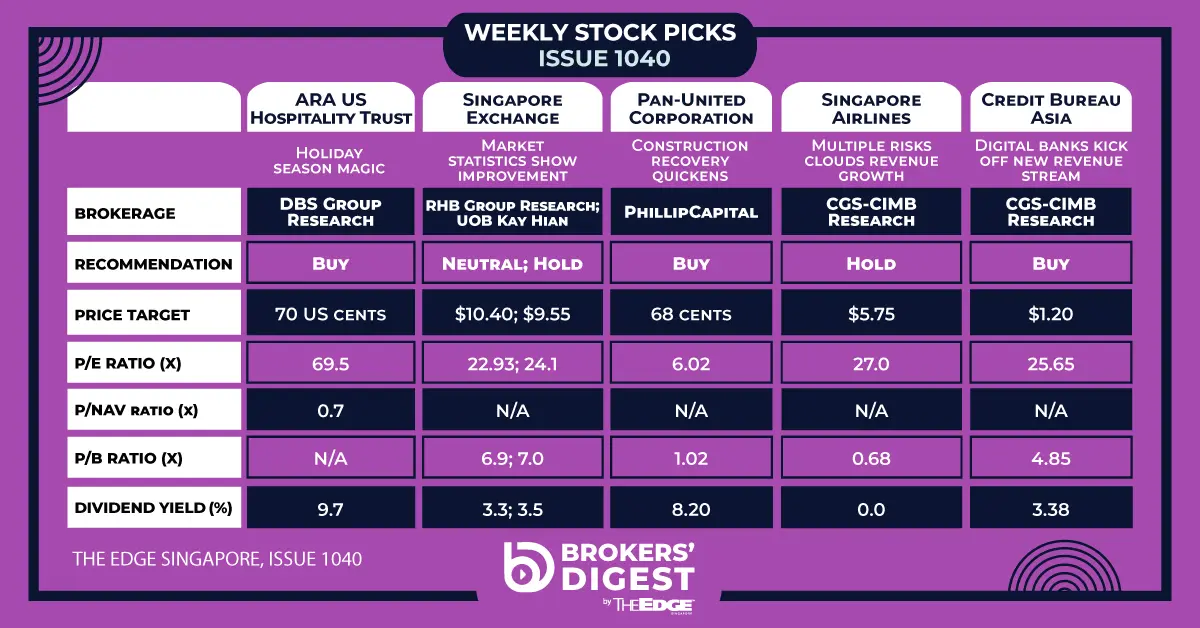

Pan-United Corp Ltd ADD, TP S$0.57, S$0.46 close

1H22 net profit jumped 94% yoy on the back of better profit spreads. RMC EBITDA margin came in strong at 9.4% in 1H22 (vs. 1H21 9.1%). The group proposed a 0.5 Scts interim dividend. We reiterate our Add call with a TP of S$0.57, based on 6.6x FY23F EV/EBITDA.

Strong recovery in 1HCY22; more to come

- BRC and PanU reported strong sets of results, as both companies recorded operating margin expansions from favourable profit spreads.

- ASPs of RMC and steel bars are likely to stay elevated in the near-term. Volume recovery and easing labour shortage should support further recovery.

- Reiterate sector Overweight. BRC is our sector top pick given its relatively attractive valuation and higher dividend yield.

Building material players reported strong sets of results

BRC saw its 3QFY9/22 net profit double yoy to S$20m, while PanU’s 1H22 net profit jumped 94% yoy to S$13m. Both companies’ latest reported financials came in ahead of our expectations. The stronger profits were attributed to 1) stronger volume delivery with the recovery of construction activities in Singapore, 2) higher ASPs enabling cost past through, and 3) improved operating leverage. On the back of the strong results, we raise our BRC FY22-24F EPS by 8.0-8.7%, and PanU FY22-24F EPS by 9.2-12.5%.

Output recovered well despite some dampening effects in 2QCY22

Based on advanced estimates released by the Singapore Ministry of Trade and Industry (MTI), the local construction sector grew 3.8% yoy in 2QCY22, faster than the 1.8% yoy expansion in 1QCY22. The recovery was mainly helped by the relaxation of border restrictions on the inflow of migrant workers. That said, MTI pointed out the value-add of the sector in 2QCY22 was 24% below pre-pandemic levels. Pace of recovery was partly dampened in 2QCY22 by 1) increased workplace incidents (and lower productivity) given time needed to train the newly replenished workforce, and 2) increased number of stop work orders at construction sites due to increased dengue and Covid-19 cases reported. Nevertheless, we view these as transient issues which should be alleviated in the upcoming quarters. We still expect further recovery in construction activities in 2HCY22F.

Order books remain robust; reiterate sector Overweight

We note that construction companies’ order books remained robust on the back of strong demand for public housing and infrastructure projects as Singapore emerges from the Covid-19 pandemic. We believe that this will continue to bode well for the demand building materials in the medium term. Hence, we reiterate our sector Overweight call on the building materials players. BRC Asia remains our sector top pick, given its attractive valuation (c.6x CY23F P/E and dividend yield of c.10%). Re-rating catalysts include a faster-than-expected pace of recovery in Singapore construction activities. Key downside risks include counterparty credit risks, retightening of measures at construction sites, and margin erosion from higher cost pressures.