MONTHLY REVIEW AND OUTLOOK

REVIEW: The FSSTI gained 3.5% mom in Jul 22 to 3,095.59. For the month, the index was lifted by a large gain in the technology (+5.7% mom) sector but dragged down by losses in the property (-4.0% mom) and plantation (-2.2% mom) sectors.

Singapore’s factory production growth slowed to 2.2% in June, down from 10.4% in May, as the sector was dragged down by softer electronics output and declines in pharmaceuticals and chemicals.

The linchpin electronics cluster cooled to growth of just 2.3% yoy, against 22.9% in May.

Output in Singapore’s key semiconductors segment shrank by 2.6%, reversing the previous month’s expansion of 32.1%. Meanwhile, the other electronic modules and components segment declined by 23.5%, as the Economic Development Board (EDB) noted “lower export orders from China”.

On a seasonally adjusted monthly basis, manufacturing output fell 8.5% in June, or by 6.9% after stripping out biomedical manufacturing.

For the half-year to Jun 22, Singapore’s manufacturing sector grew by 5.6% yoy, or 7.5% excluding biomedical manufacturing.

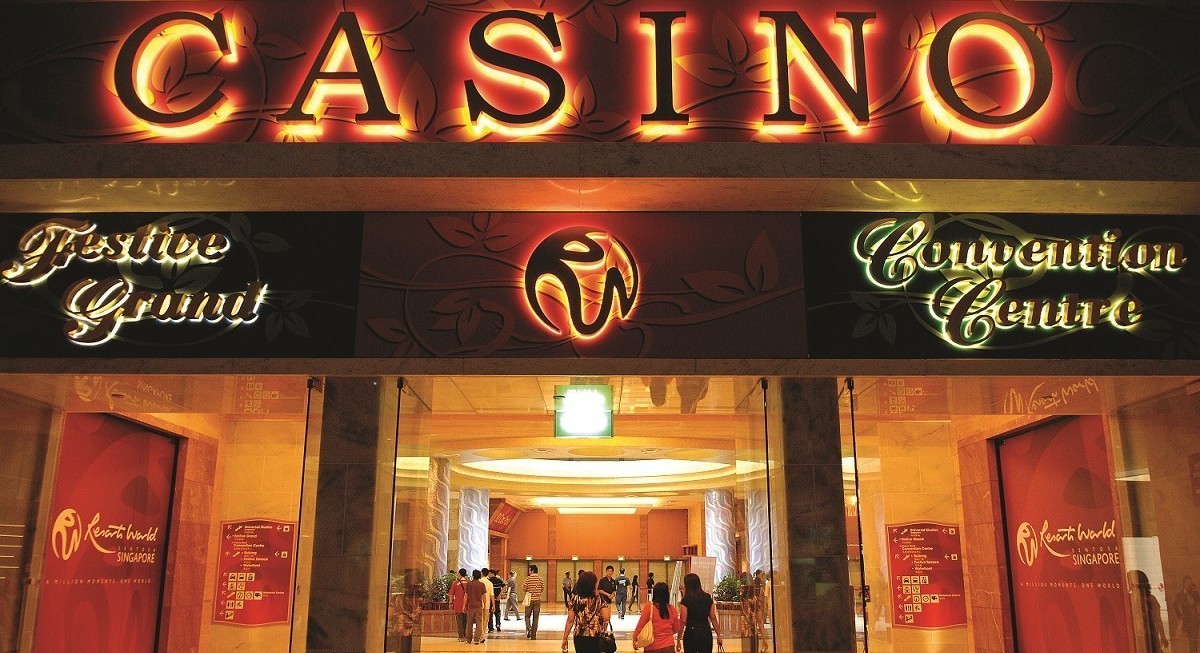

STRATEGY: Some of our top large-cap picks are DBS, CapitaLand Invest, Genting SP, Keppel Corp, SIA Engineering, Lendlease REIT, Venture Corp, Yangzijiang Shipbuilding, ComfortDelgro and Ascott REIT. As for the small/mid-cap sector, our top picks are AEM, Frencken and Sembcorp Ind.