Alpha Picks: Add Nanofilm, Remove AEM, Venture And ComfortDelGro

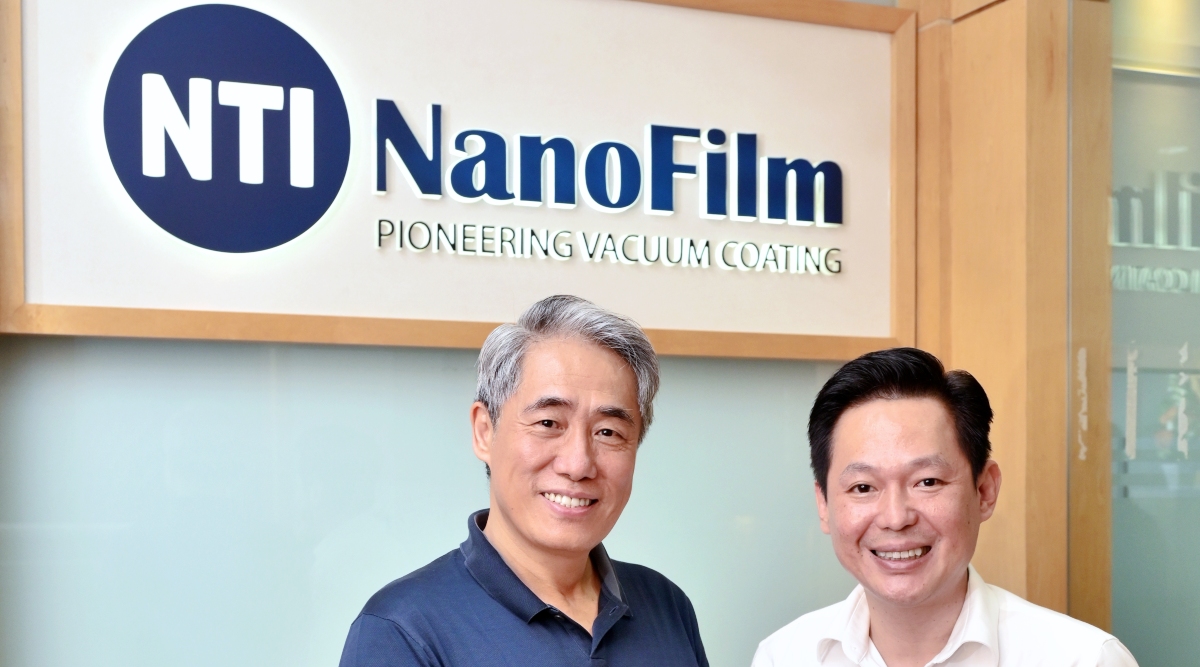

Our Alpha Picks outperformed the STI in Aug 22, increasing by 2.9% on a market cap weighted basis vs the market’s 0.3% increase. For Sep 22, we add Nanofilm as we believe new product launches and market expansions will lead to a strong 2H22. We have also taken out AEM as we expect a weaker 2H22, and removed ComfortDelGro due to its recent exclusion from the STI. Additionally, we have taken profit on Venture as we see no near-term catalysts.

WHAT’S NEW

• Market review. Our Alpha Picks portfolio saw a broad-based outperformance in Aug 22, with the tech manufacturing, banks and industrial sectors being clear outperformers. Despite global geopolitical uncertainty, most corporates continued to deliver yoy profit growth, in line with market expectations. In addition, overall market sentiment marginally improved as expectations for significant future interest rate hikes eased somewhat. However, facing an uncertain global macroeconomic outlook, stock investors were broadly on the sidelines, leading to a muted 0.3% increase for the STI in Aug 22 as compared to Jul 22 which saw a 3.5% increase.

• Outperforming in Aug 22. Our Alpha Picks portfolio outperformed during Aug 22, increasing by 2.9% on a market cap weighted basis vs the STI’s 0.3% increase. Five stocks in our Alpha Picks recorded positive absolute returns of more than 4%, largely led by Sembcorp Industries (+17.9% mom), DBS (+4.7% mom), Yangzijiang Shipbuilding (+4.3%), AEM (+4.1%) and Venture Corp (+4.0%). The stock which saw a weak month was CapitaLandInvest (-5.9% mom), which reported weaker-than-expected 1H22 results, dragged by ongoing COVID-19 lockdowns in China and higher rental rebates.

• Switching out AEM for Nanofilm while removing ComfortDelGro and Venture. We switch out AEM for Nanofilm as we expect Nanofilm to experience a stronger 2H22 from upcoming positive newsflow. We also remove ComfortDelGro due to its exclusion from the STI index thus leading to an expected short-term share price underperformance, and take profit on Venture as we see no-near term catalysts