FED hiked interest rates by 75 basis points as expected by market participants. Powell indicated a strong US economy, possibly giving them more room for monetary tightening in order to bring down inflation.

Yield on the 2-year treasury bills shot up to 4.121%, the highest since 2007. FED hawkish tone remained and based on its ”dot plot” released, indicate a peak of 4.6% in 2023.

Whether the economy can stay unscathed with that level remains to be seen. Buckle up and enjoy the journey.

Corporate America remained strong with debt to EBITDA ratio at a healthy levels. Most companies had taken the opportunity in 2020-2021 to reprice their outstanding debt. Consumers remained strong with US consumption staying at elevated levels. In fact, more than 75% of the S&P500 companies beat estimates during the Q2 earnings season. Many C suites quoted inflation as one of their concern heading toward the second half of the year. With a tight labour market in the US, this is expected to further compress margins but those companies who are enjoying pricing power will be able to pass this to their end customers. Unemployment stays at a health 3.6%, within FED target of 4%.

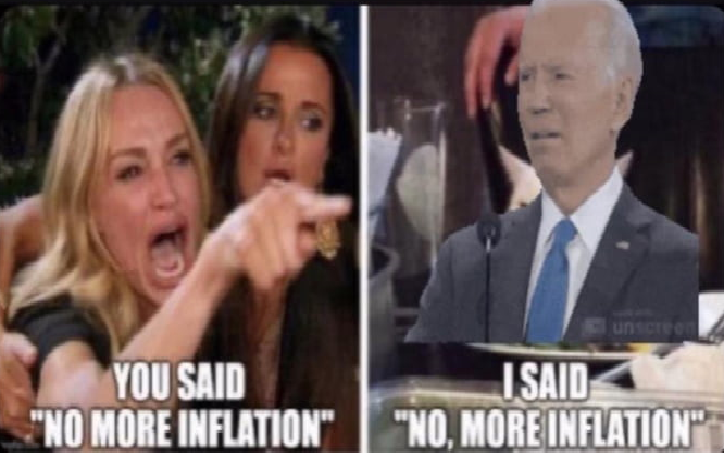

In my opinion, the current inflation problem started back then in 2020 when the central bank “overestimated” the economic damage that covid might bring and unleashed unprecedented QE, flooding the market with excess liquidity that drove prices up everywhere. The amount of liquidity was much more than what it was back then during and post Global Financial Crisis.

Of course we saw the market pulling back since the turn of June, with aggressive monetary instituted by the FED. Many have cited 1981 as an example to what is happening in the market today. But economically, it’s not the same. Then the unemployment numbers were high around 7-8%. Corporate earnings were not doing well and inflation was sky high. Volcker raised interest rates up to almost 20% to aggressively tackle inflation. A recession was orchestrated, though a fast and shallow one. The S&P500 experienced a peak to bottom of around 10% and closed the year down around 5% in 1981.

What we have today is S&P500 doing a peak to bottom pullback of around 24% since the high in November 2021.

The liquidity that the FED is trying to draw out from the system today is what they have first provided back then in 2020. It’s like giving you $10 then and trying to take back $5 today. So can the market accept this? My take is yes, not forgetting corporate earnings was growing exponentially back then in 2021.

Again to re-establish my take back then in June, that S&P500 had most probably find its bottom at ~3,650. At 3,800 to 3,880 levels, investors should start accumulating positions for 2023.

Please read disclaimer.