Keep abreast of market moving events with CIO’s weekly bulletin

Chief Investment Office8 Nov 2022

- Equities: Potential slowing of rate hikes stoke DM equity rally; HK and China markets slide

- Credit: US IG issuers most insulated against rising rates

- FX: Greenback failed to get a boost from the rise in UST yields; EM currencies breathed easier

- Rates: Spikes in 2Y and 5Y yields to fade if CPI beats expectations

- Thematics: Physical stores to make a comeback as consumers shift back to pre-Covid purchasing habits

Global equities close lower, led by US decline.Central banks were in focus this week as the US Federal Reserve and Bank of England continued their tightening campaigns with 75 bps hikes. Global equities dipped -1.4% for the week; Developed Markets fell -2.1% while Emerging Markets rallied 4.7%.

In US, nonfarm payrolls data beat expectations as 261,000 jobs were added in October. However, further rate hike fears fuelled a week-to-date decline for major indices; the S&P 500 and Nasdaq fell 3.3% and 5.6% respectively. Europe closed the week in green on the back of positive corporate earnings. The Stoxx 600 was up 1.5% and FTSE 100 gained 4.1% for the week. Asia equities rose on speculation of easing Covid policies in China; the Hang Seng, HSCEI, and SHCOMP added 8.7%, 9.0% and 5.3% respectively.

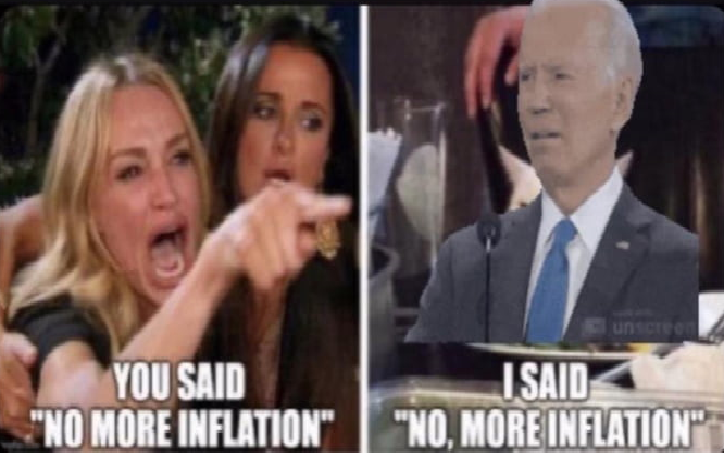

Topic in focus: US midterm election to have limited impact on equity markets.After months of intense campaigning in the primaries, the US midterm election is heading down to the wire. Despite initial ground gained by the Democrats in the wake of the Supreme Court’s reversal of Roe vs Wade, the Republicans have since regained the lead and forecasts from FiveThirtyEight.com suggests an 84% chance of the Grand Old Party (GOP) regaining the House. However, the Senate race remains a toss-up. According to FiveThirtyEight.com, the Republicans have a marginal lead here with 59% chance of winning while Democrats hold 41% chance.

A Democratic clean sweep will translate to greater passage of measures from Biden’s fiscal agenda and a more elevated path for policy rates. Conversely, a Republican victory in both the House and Senate will lead to an opposite outcome. A divided congress, meanwhile, will result in limited passage of fiscal measures during Biden’s remaining Presidential term. In any case, we believe the overall impact from the US midterms will be limited. Instead, the bigger drivers for equity markets at this juncture are corporate earnings, recession risks, and Fed policy path.