FY22 Results Preview: Expect Robust Results, Backed By Higher Volatility

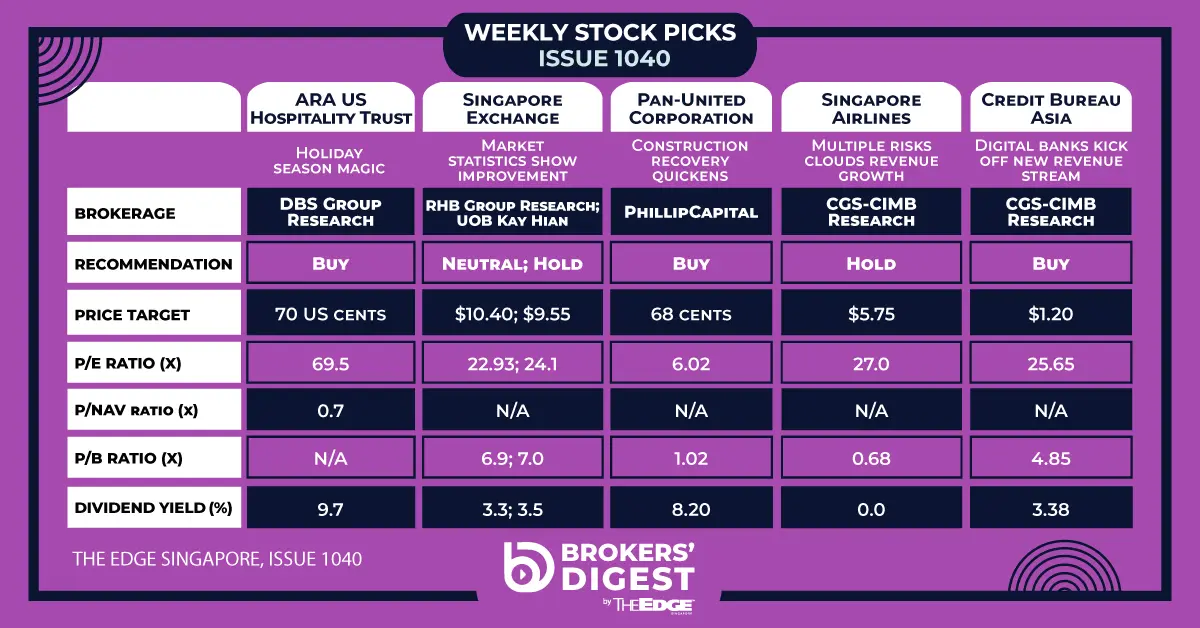

With SGX’s FY22 results approaching, we reviewed SGX’s annual market statistics and adjusted our forecasts accordingly. SGX is set to post strong 2HFY22 results as, excluding the cash equities segment, we project solid growths from the other segments based on sturdy FY22 volumes. With SGX trading below its historical PE mean, we think that there is upside at current price levels as volatility persists. Thus, we upgrade to BUY with a higher target price of S$11.09.

WHAT’S NEW

• Lower securities value. In line with expectations, Singapore Exchange’s (SGX) FY22 securities turnover value declined 5.7% yoy, but this was mitigated slightly by a strong 2HFY22. Securities turnover value rose 13.2% hoh in 2HFY22, caused by increased volatility from the Ukraine-Russia conflict along with rising inflation. However, 2HFY22 turnover value fell 4.5% yoy, continuing its overall downtrend. We expect the downward trend to continue as fears of an upcoming recession and record-high inflation would depress securities trading activity.

• Robust derivatives volume. Total FY22 derivatives contract volume rose 6.8% yoy as demand for risk-management surged in 2HFY22 (+14.2% yoy, +12.7% hoh) due to heightened volatility, in line with expectations. Total FY22 volumes for FTSE China A50 Index Futures Contracts grew 9.1% yoy, an impressive showing despite competition from HKEX while other equity-linked futures such as MSCI Singapore Index (+14.7% yoy), FTSE Taiwan Index (+11.7% yoy) and Nifty 50 Index (+14.4% yoy) increased as well.

• Forex and commodity segments (FICC) outperformed. Total FY22 forex futures volume rose 10.4% yoy, led by the USD/CNH and KRW/USD futures contract which grew 22.2% yoy and 138.7% yoy respectively. 2HFY22 saw record-high forex volumes (+13.6% yoy, +26.5% hoh) as ongoing global macroeconomic uncertainty increased demand for risk management. Total FY22 commodity derivative volumes also grew 21.3% yoy, led by iron ore derivatives (+22.7% yoy) and forward freight agreement

derivatives (+29.1% yoy).

STOCK IMPACT

• Cash equities: Moderation to continue. We expect FY22 revenue from the cash equities segment to decline 6-7% yoy to S$389.2m, based on lower securities daily average traded volume (SDAV) assumptions of S$1.28b as compared to S$1.35b in FY21. Based on 2HFY22 market statistics, we expect 2HFY22 revenue to grow slightly by 4-5% hoh, due to higher trading and clearing revenue from elevated trading activity. However, on a yoy basis, 2HFY22 revenue is expected to fall 6-7% yoy. Positive upside may come from higher revenue contribution from new listings and ETFs/warrants/DLCs.

• Equity derivatives: Growth led by China A50. For FY22, we expect revenue from equity derivatives to grow by 7-8% yoy to S$310.7m due to higher average fee per contract (S$1.34 in FY21 to ~S$1.52 in FY22) and higher trading volumes (172.2m in FY21 to 180.7m contracts in FY22). The increase in trading volumes was largely led by SGX’s FTSE China A50 volumes (105m, +9.1% yoy), which have remained robust and exceeded our expectations in the face of competition from HKEX, surpassing our previous FY22 96m contract assumption. Furthermore, HKEX’s MSCI China A50 volumes have relatively underperformed in FY22, solidifying SGX’s dominant market position. As the China A50 futures market grows, we reckon that SGX would be able to maintain its market share due to its strong liquidity on its exchange and multi-asset offerings. Potential upside may come from earlier-than-expected increase in treasury income from the recent interest rates hikes, although this is unlikely given the 6-9 months’ time lag.

• FICC: Star performer. Earmarked as a core revenue growth driver, we forecast FY22 revenue from the currencies and commodities segment to increase 23.2% yoy, on the back of strong volumes in the USD/CNH and KRW/USD futures. Also, the consolidation of Maxxtrader acquisition in Jan 22 is expected to boost forex trading and clearing revenue for 2HFY22. For commodity derivatives, outperformance from forward freight agreements, iron ore and petrochemical derivatives also drove volumes higher amidst ongoing global supply chain issues. The introduction of dairy derivatives was also a

welcome boost as trading volumes have grown steadily.

• Data, connectivity and indices (DCI): reliable source of revenue. Post acquisition of Scientific Beta in FY21, we expect DCI revenue to grow 4-5% yoy in FY22, given growing secular demand for index tracking and ESG/thematic investing.

STOCK IMPACT

• Mixed blessing of interest rate hikes. To tackle stubborn and record-high inflation, the US Fed has already raised interest rates three times in 2022, with the latest hike being a 0.75% hike. The Fed is expected to continue raising rates going into 1HFY23 with another 0.75% rate hike expected in Jul 22. With rising interest rates, we expect a significant boost in treasury income starting 2HFY23. However, this may depress securities trading volumes and impact the cash equities segment in FY23.

EARNINGS REVISION/RISK

• We increase our FY22-24 earnings by 3-4%, on the back of strong results from the equity derivatives and FICC segments, as well as higher treasury income assumptions caused by more aggressive interest rate hikes than previously anticipated. We have increased our FY22/FY23/FY24 earnings to S$449.7m (S$431.1m previously), S$504.7m (S$486.3m previously) and S$553.2m (S$539.0m previously) respectively. We expect FY22 revenue/net profit to grow by 5.2%/8.6% yoy, and FY23 revenue/net profit to grow by 1.0%/12.2% yoy.

VALUATION/RECOMMENDATION

• Upgrade to BUY with a higher PE-based target price of S$11.09 (previously: S$9.55). We have pegged and rolled over our PE multiple to 23.5x FY23F earnings, +1SD of SGX’s historical forward PE. As SGX is currently trading below its historical mean, we reckon that there is some upside at current price levels. Robust contributions from FICC and equity derivatives are set to continue in FY23 due to volatile macroeconomic conditions whilst higher treasury income from interest rate hikes is expected to start from 2HFY23. With a moderate yield of ~3%, we like SGX for its resilient business model that benefits from global economic uncertainty.