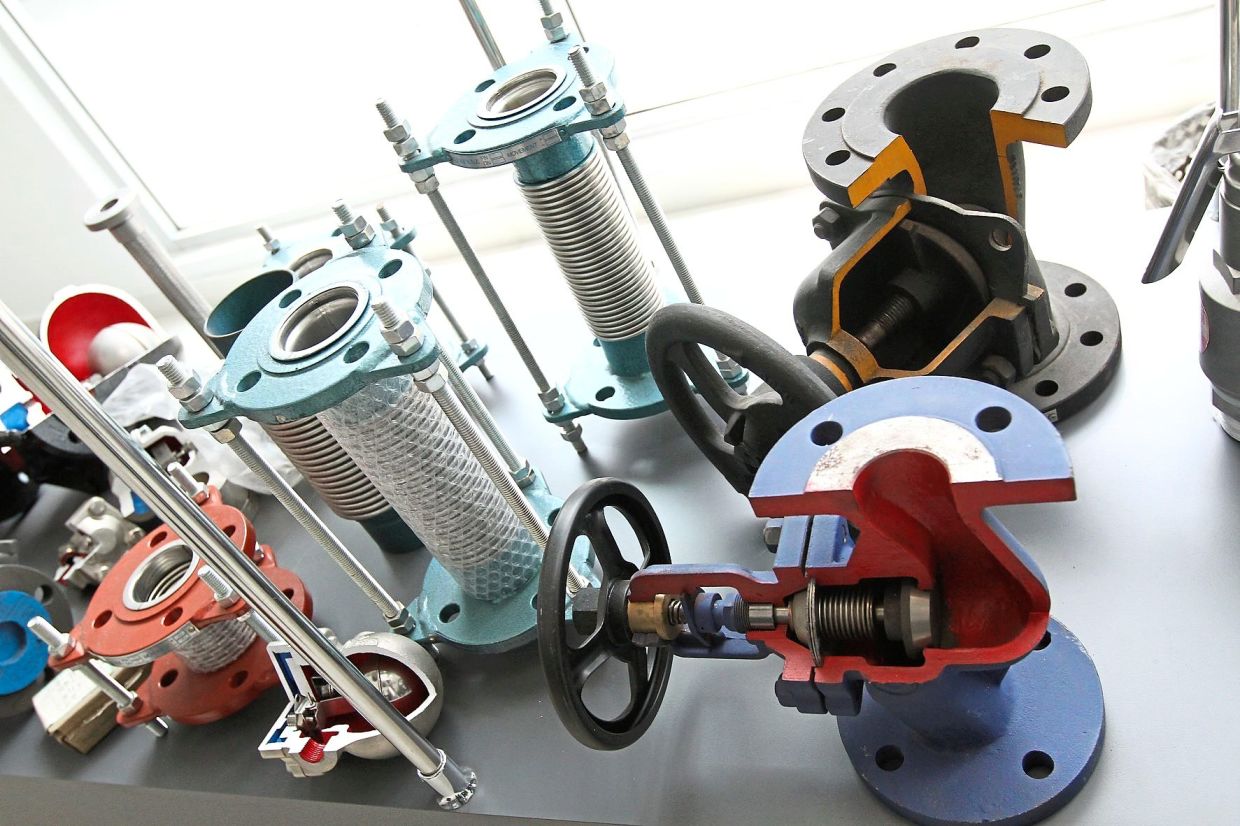

Leader in industrial valves and equipment

- We initiate coverage on Danco, a leading domestic player in process control equipment as at FY21, with Add and RM0.44 TP (10x CY23F P/E).

- We project FY21-24F core net profit CAGR of 9.8%, driven by stable and recurring earnings, exclusive tie-ups with global brands and M&A potential.

- We think current valuations are attractive at 8.6x CY23F P/E, a 15.8% discount to its net tangible assets (NTA) with net cash of 19.2 sen/share.

Leading provider of process control equipment

Listed on the Bursa Malaysia, Dancomech’s (Danco) core business is trading and distribution of process control equipment (40.3% of FY21 revenue). In our view, the beauty of this segment lies in its stream of recurring revenue (4-year revenue CAGR of 7.4% for FY17-21), backed by demand from maintenance works (65% of FY21 sales) as well as new projects (35%) in the petrochemical and palm oil sectors. Its competitive strengths are its: i) value-added services, i.e. consulting, ii) exclusive tie-ups with global brands, and iii) broad clientele (vs. just hardware/retailers). This allows it to post better GP margin (FY19-

21: 28-36.7%) vs. typical trading business (we estimate 10-15%).

Growth to be driven by acquired subsidiaries

We expect Danco’s future revenue growth to be driven by its revenue diversification strategy, with four acquired subsidiaries since its IPO in 2016. We see strong growth potential in two key subsidiaries: metal stamping and electronic & electrical (E&E) engineering. For the metal stamping division (we estimate 3-year topline CAGR of 17.4% in FY21-24F), we believe Danco will likely to grow its capacity by 15-20% towards endFY22F, backed by strong demand from its existing clients and ongoing efforts to secure potential new ones. It also expects substantial contribution from its E&E engineering division (we estimate 3-year topline CAGR of 45.8% in FY21-24F), backed by a robust orderbook (we estimate at total RM7m up to end-CY23F).

Undemanding valuations with strong balance sheet

We estimate Danco is currently trading at an undemanding 8.6x CY23F P/E, a 14% discount to its 5-year historical mean (10.2x). Also, it is trading at a 15.8% discount to its net tangible assets (NTA) of 44 sen/share. It is in a net cash position of RM85.0m (as at 30 June 2022), at 50.5% of its market cap. This will support its attractive dividend yields of 5.1-5.9% for FY22-24F, in our view. We also believe its strong cash position provides opportunities for Danco to seek out more earnings-accretive M&A deals.

Initiate coverage with Add, TP of RM0.44 (10x CY23F P/E)

We expect Danco to post a core net profit CAGR of 9.8% in FY21-24F, backed by: i) recovery in sales in its trading division from the Covid-19 pandemic period (3-year CAGR of 8.7% for FY21-24F) and ii) higher contribution from other subsidiaries (mainly metal stamping and E&E engineering). We initiate coverage on Danco with an Add call and TP of RM0.44 (10x CY23F P/E, near its 5-year historical mean). Re-rating catalyst: better-than-expected sales. Downside risks: spike in input costs and lower sales volume.