- BUY Entry – 0.780 Target – 0.835 Stop Loss – 0.750

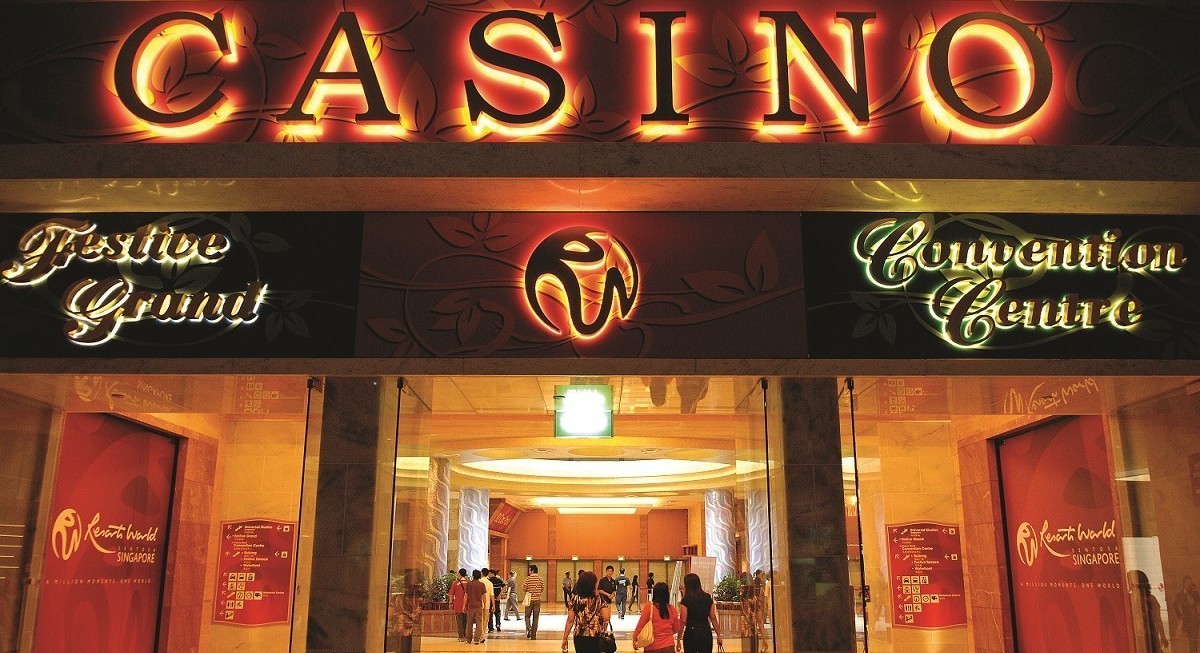

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index.

- Hotel prices hit a 10-year high. Singapore hotel room prices exceeded the pre-Covid level and hit a high in almost a decade in July 2022. As of July, the average room rate reached S$259/night, up c.70% YoY. The strong demand was driven by the increase in visitor arrivals amidst easing Covid-19 restrictions. Visitor arrivals in Singapore rose for the sixth straight month in July to 726,601, up from 543,733 in June, according to the tourism board.

Singapore hotel room price by tier

(Source: Singapore Tourism Analytics Network)

- Upcoming high-profile events pushing hotel prices higher. This week, hundreds of chief executives, crypto investors and innovators, and even a Bollywood star are flying in for a series of high-profile Mice events. The Singapore Tourism Board mentioned that nearly 90,000 delegates would be expected to attend about 25 Mice events around this period, similar to the number of events held pre-Covid-19. Some of the events held this week include the crypto conference – Token2049, the 20th Forbes Global CEO Conference, the ninth annual Milken Institute Asia Summit and the inaugural edition of the Time100 Leadership Forum. A number of these events will be held concurrently with the Formula One Grand Prix, taking place between Friday to Sunday. The entertainment lineup this weekend includes performances by Marshmello, Westlife and Green Day. Other big names in entertainment coming to Singapore later this year include Justin Bieber, Maroon Five, Guns N’ Roses and Jay Chou.

- Updated market consensus of the EPS growth in FY22/23 is 82.1%/60.7% YoY respectively, which translates to 28.2x/17.5x forward PE. Current PER is 53.1x. Bloomberg consensus average 12-month target price is S$0.95.

(Source: Bloomberg)